cryptocurrency tax calculator uk

This is known as a Capital Gains Tax and has to be paid in most countries such as the USA UK Canada etc. HMRC treats cryptocurrency as property under UK tax law.

Capital Gains Tax Calculator Ey Global

UK crypto investors can pay less tax on crypto by making the most of tax breaks.

. CoinTracker helps you become fully compliant with cryptocurrency tax rules. Crypto-currency tax calculator for UK tax rules. 40 Higher Rate up to 50271 150000.

Online Crypto Tax Calculator with support for over 400 integrations. Additionally for each sale or exchange you will need the following information. Koinly generates a report with the income from your cryptocurrencies.

45 Additional Rate for more than 150000 income. If youve sold traded earned or spent cryptocurrency then you do need to calculate if you owe any tax. Tax on this cryptocurrency exchange in the UK will include capital gains tax.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. These are the income tax bands in the UK charged on the income earned. UK capital gains and income tax support.

Including UK specific rules around mining staking and airdrops. Mining and validating. This allowance was 12500 for the 20202021 tax year.

Download your tax reports in minutes and file with TurboTax or your own accountant. The free trial is available for 30 days. We do not offer final financial year reporting in the free trial.

How do cryptocurrency taxes work. CryptoTaxCalculator is designed to support the unique HMRC reporting requirements including UK-specific Same Day and Bed Breakfast. This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency.

You might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. The original software debuted in 2014. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep.

If you are not tax resident in the UK or do not have a domicile in the UK then you can benefit from favourable tax rules. Although all information provided has been verified in communication with HM Revenue. This matters for your crypto because you subtract this amount when calculating what.

Mining cryptocurrency will either be considered a hobby or fully-fledged business. For individuals income tax supersedes capital gains tax and applies to profits. Regardless of the cryptocurrency youre paid in or who pays you youll have to pay income tax and national insurance contributions.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. 49 for all financial years. Check out our UK tax guide for information for UK individuals.

Income report - Mining staking etc. However exchange of one cryptocurrency for another will also be considered disposal. Crypto you inherit.

Full support for US UK Canada and Australia and partial support for others. How to calculate your uk crypto tax calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc. Since then its developers have been creating native apps for mobile devices and other upgrades.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

0 Personal Allowance up to 12570. 12570 Personal Income Tax Allowance. CoinTrackinginfo - the most popular crypto tax calculator.

Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. UK crypto tax basics. For that please consult a financial adviser or tax consultant.

Simply copy the numbers onto your tax return and be done in minutes. Your first 12570 of income in the UK is tax free for the 20212022 tax year. Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources.

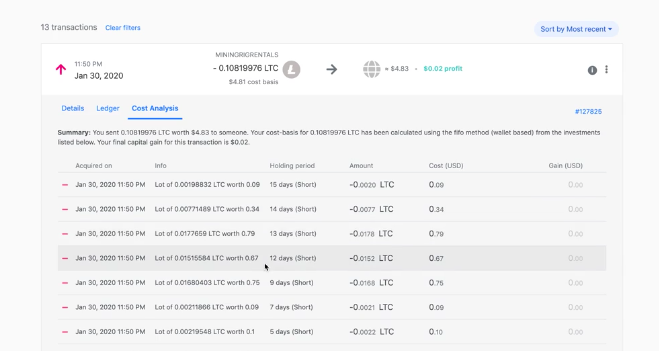

Youll need your transaction history in order to track your tax lots. From a tax perspective investing in cryptocurrency is very similar to investing in other assets like stocks bonds and real-estate. We are proud to be hosting an online seminar.

Income from Mining Staking Forks etc has to be reported in your annual tax return. 20 Basic Rate up to 12571 50270. Uk crypto tax calculator with support for over 100 exchanges.

The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for minus any exchange fees. That means you calculate your capital gains and if the result is below the limit you dont need to.

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios such as DeFi loans DEX transactions gas fees leveraged trading and staking rewards. Crypto tax breaks. If activities are considered trading they will face different cryptocurrency tax in the UK.

Crypto is taxed in the same way as Gold and real estate. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. Income tax is generally applied to individuals who are buying and selling or receiving cryptocurrency as part of a trade.

Become tax compliant seamlessly. Calculate your gains by applying same day 30 day and asset pooling rules. The cryptocurrency tax calculator handles this automatically using your investment and trading history.

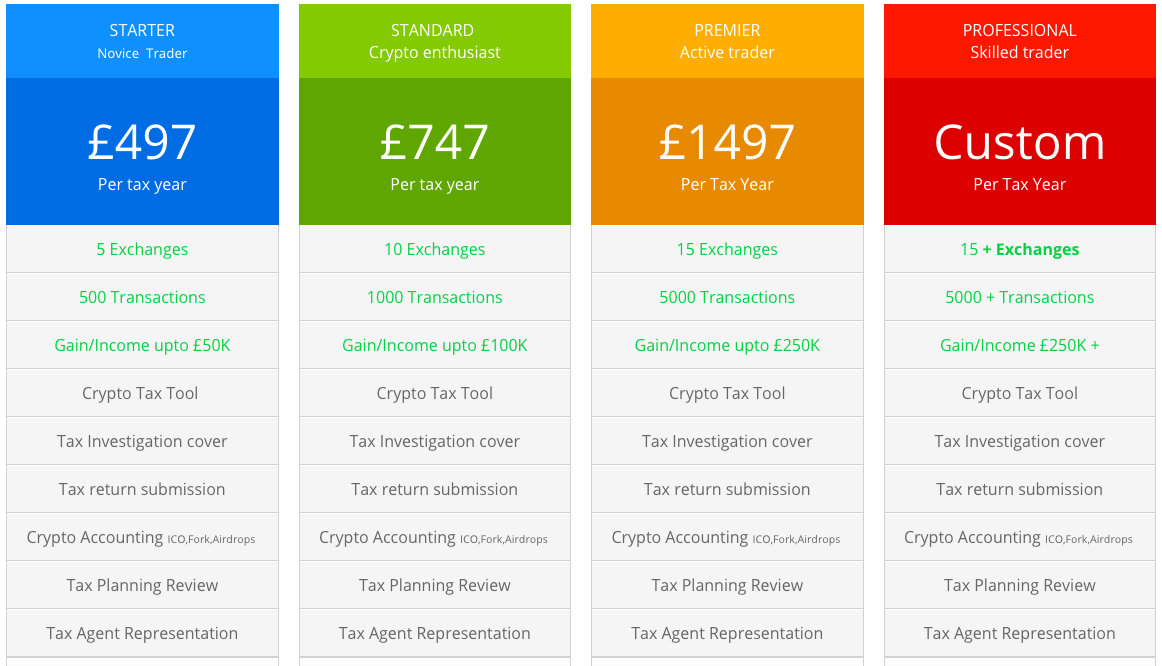

Best Bitcoin Tax Calculator In The Uk 2021

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

U K Fca Issues Final Guidelines On Crypto Regulation Btcmanager Financial Instrument All Cryptocurrency Cryptocurrency

Bitcoins Bitcoininvesting Bitcoin Bitcoin Transaction Best Cryptocurrency

Wade S Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazon Co Uk Software

Pay Calc Uk In 2022 Finance Apps Calc Paying

Best Bitcoin Tax Calculator In The Uk 2021

Bitmarket Is Clean And Modern Design Responsive Html Template For Bitcoin Crypto Currency Exchange And Trading Company W Templates Cryptocurrency Bitcoin

Best Bitcoin Tax Calculator In The Uk 2021

Cryptocurrency Outline Icons Cryptocurrency Outline Cloud Mining

![]()

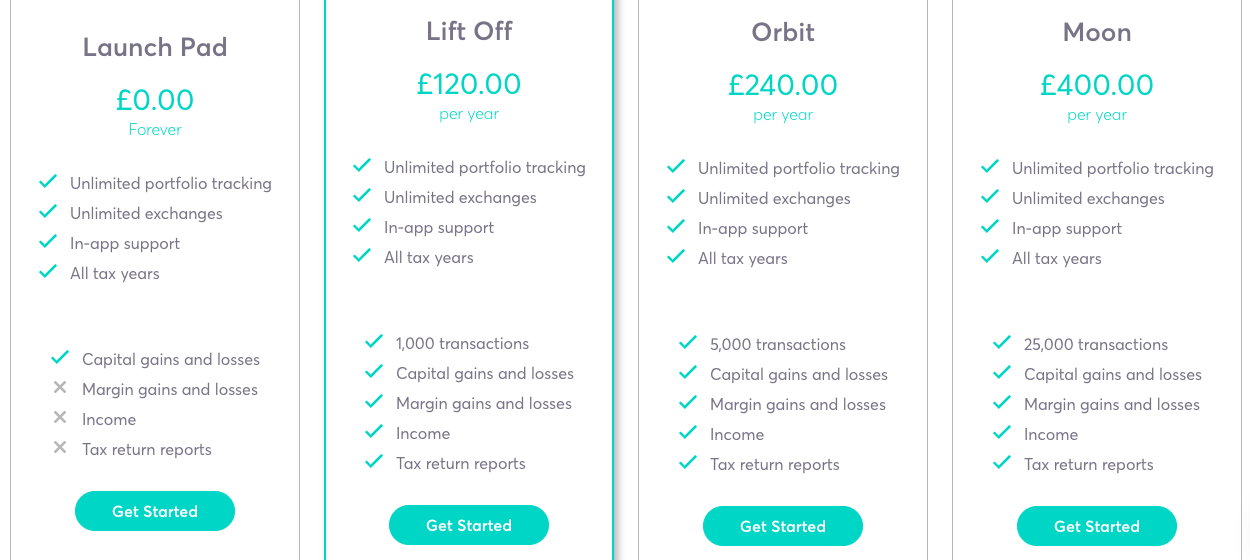

Cointracking Crypto Tax Calculator

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Best Bitcoin Tax Calculator In The Uk 2021

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Crypto Tax Calculator Review Everything You Need To Know About This Cryptocurrency Tax Software Tax Software Cryptocurrency Trading Cryptocurrency

![]()

Cointracking Crypto Tax Calculator

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template